On-demand warehousing promises cost savings

Many aspects of logistics have been transformed by 21st century net-based applications, particularly in the fields of matching parties or ‘the sharing economy’.

Freightex and Transport Exchange are good UK examples in transport. Now it seems that trend is set to extend to warehousing.

This marketplace model has entered the world of third party warehousing and coined a new term: ‘On-demand warehousing’. New web-based businesses are creating Airbnb style matching sites for those with spare warehouse space and those requiring storage, chief amongst them Flexe in the US and Zupplychain in the UK.

Flexe – launched in late 2014 – has raised over $20m in three fundraisings, the most recent $14m in July 2016. Zupplychain is younger, having gone live for customers in May 2016. Both go beyond the ‘list and connect’ model by developing mini warehouse management systems for customers to manage stock in third party warehouses through the website.

Some customers have emergency storage problems to solve. Others have outgrown their storage facilities and are looking to on demand warehousing to help them expand without adding fixed costs. In both cases a third party warehouse will often be cheaper than the traditional solution of taking on fixed costs with a new unit.

Owning or leasing a warehouse can make economic sense but usually only when near to capacity. This leaves a business with little flexibility when sales spike up. Conversely, when sales fall costs cannot be reduced sufficiently to match the sales decline. With a third party warehouse, storage costs are at the margin, so the likes of Zupplychain and Flexe enable manufacturing and distribution businesses to grow without the exposure to the risks of fixed costs.

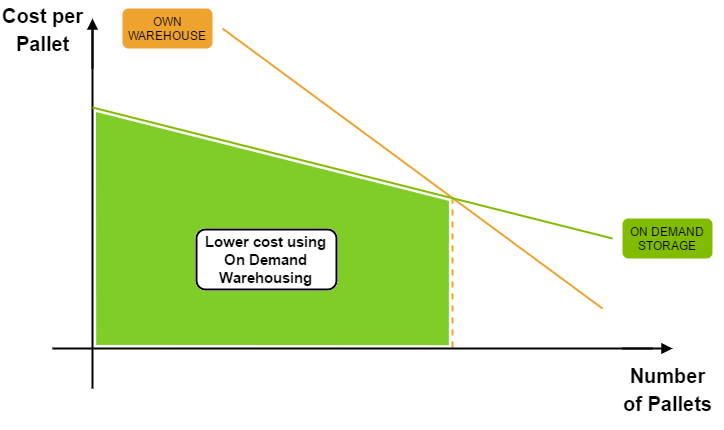

The underlying principle is that newly owned warehouses incur fixed and semi-variable costs immediately while almost certainly providing more capacity than needed. However, an on-demand warehouse spreads the fixed costs across all its customers so storage is charged closer to marginal cost. The diagram below compares the typical total cost per pallet stored in a third party warehouse with an owned or leased warehouse.

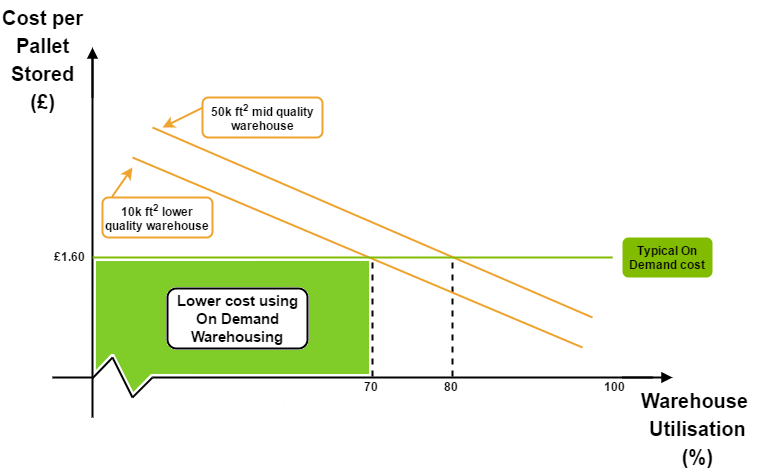

To illustrate this we can see the comparison between a typical UK third party storage rate, a low-cost 10k square foot unit and a mid-cost 50k square foot unit. The on-demand option is lower cost up to around 70-80% warehouse capacity utilisation of the owned warehouses.

The number of pallet movements is also a factor defining the point at which an owned and operated warehouse becomes economically viable. Where movements are low, a warehouse operative may be under-utilised and the cost per pallet movement high, compared to the marginal cost in a third party warehouse.

On demand warehousing is yet another example of the sharing economy that has spawned the likes of Airbnb and crowd-funding, tapping into under-utilised resources and frustrated demand. The likes of Flexe and Zupplychain have coupled the sharing economy principle with the dynamics of warehousing to create new and exciting business models.